Head of Household status tax payers in most states have a relatively higher standard deduction and more family oriented credits available to help reduce their income tax liability.

Head of Household is the filing type you select if you are unmarried and provide a home to at least one qualifying child or dependent.įiling as Head of Household generally results in paying lower federal and Iowa state income tax rates compared to the other four filing statuses. Chapter 3 Activity - Taxes Marginal Tax Rate Individual Income Tax Brackets (2020) Head of Single, taxable Joint, taxable income over: income over: Household, taxable income over: 10 0 0 0 12 9,875 19,750 14. These five filing status are visible as check boxes on both the IRS Form 1040 and the Iowa Form 1040. Reporting and paying tax To file a return, complete a T2 Corporation Income Tax Return and either a Schedule 427 British Columbia Corporation Tax Calculation. There are five filing status available to Iowa state taxpayers: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow. What is the Iowa Head of Household income tax filing status? You can use the Tax Withholding Estimator to estimate your 2020 income tax.

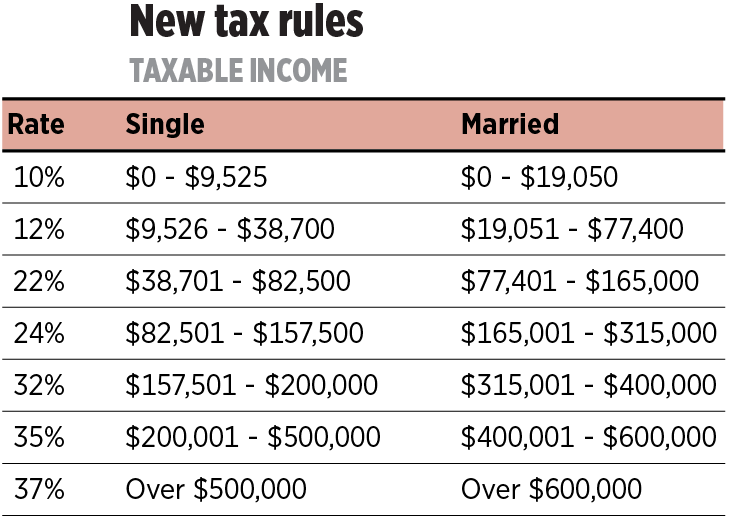

For help with your withholding, you may use the Tax Withholding Estimator. The information you give your employer on Form W4. Read the Iowa income tax tables for Head of Household filers published inside the Form 1040 Instructions booklet for more information. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. Marginal tax rate: The rate at which the last dollar of income is taxed. Short-term gains on sales of assets you held for less than a year are generally subject to ordinary income tax rates instead of the capital gains tax rate. The taxable yield is 5.13%.Residents of Iowa are also subject to federal income tax rates, and must generally file a federal income tax return by May 1, 2023. Income tax rate: The various percentages at which taxes are applied Income tax brackets: The ranges of income to which a tax rate applies (currently there are seven as shown above). Tax Rate 2022 2021 2020 2019 2018 10: 0 to 14,650: 0 to 14,200. To get the equivalent taxable yield, divide 4.0% by 78% (100% - 22%). If youre a single filer in the 22 percent tax bracket for 2023, you wont pay 22 percent on all your taxable income. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for long-term capital gains) is either 0, 15.

Taxable equivalent yield = tax-free yield ÷ (100% - marginal tax bracket %) or see which includes both federal and state income tax rates.Įxample: Assume you are in the 22% tax bracket, and have an account with a 4.0% tax-free yield. You can compare yields by using the following formula: Below are the four individual tax rate schedules for 2020: Individual Tax Rate Schedules for 2020 Filing Status It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of. For example, the 22 tax bracket for the 2021 tax year goes from 40,526 to 86,375 for single. Your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes. The federal tax brackets are broken down into seven (7) taxable income groups, based on your filing status. The 20 tax bracket ranges also differ depending on your filing status.

0 kommentar(er)

0 kommentar(er)